Patents and the other forms of Intellectual Property

To round out Phase 5 we go through Patents, registered designs, circuit designs and plant breeders rights..

In Show 018 – Patents and the other forms of Intellectual Property was originally broadcast on Facebook Live on Wednesday 27 September 2017 .

Show Notes

Phase 5 of the Business Legal Lifecycle is all about intellectual property. Today, we are going to wrap up our section on IP by going into some more detail about patents and the patent process. Patents are used to protect an idea that is innovative. There are two kinds of patents in Australia. The standard patent lasts for twenty years while an innovation patent lasts for eight years. One thing to keep in mind is that a patent precludes new innovations on a product. A good example is the 3D printer which was quickly patented many years ago. This stopped other companies from improving the product and that slowed innovation. Once the patents expired the 3D printer market took off. Some of the benefits of patents include stopping someone from manufacturing your product. It also encourages companies to improve on new and innovative products.

The Process

The first thing you need to do is to determine whether your product is patentable. That is not an easy process. You have to ensure that your product is actually unique. You have to check against an enormous register of other patents. That’s not a cheap or easy process. You don’t necessarily need to get a patent to protect your rights but it is another added layer of protection.

You need a patent lawyer to help guide you through the process. You will have to pay a fee to make the actual application. It’s very rare that a patent will be immediately approved. It has to go through an examination process by patent experts.

Registered designs

Registered Designs detail what it is that is actually being patented. The costs leading up to the registration process is going to be the most expensive. You are going to need the right consultants lined up to guide you through the process so you need to make sure you pick the right ones. To be certified it needs to be a new and distinctive design. When that happens you will have the exclusive design. It’s not a quick process. It can take at least 6-12 months. Circuit designs are different. They are protected by copyright instead of patents.

If you are going to take your business international you are going to have to consider how to protect your IP overseas. You can get it registered in more than 100 other countries within 30 months of getting you Australian patent. Make sure when you get advice on international patents you understand what your fees are going to be in Australian dollars.

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

Do you want a practical guide for building systems in your Business? Don’t know where to start?

In Show 017 – Systems for Businesses originally broadcast on Facebook Live on Monday 25 September 2017 we give you a specific tool to help you build a manual for your business.

Show Notes

Today, on Fast Fix Monday we are going to discuss systems in your business. In our last episode we talked about the importance of developing a manual for your company. This can be hugely important especially when you sell the company. You are selling your processes and techniques as much as you are selling your building and equipment. Your manual should include each of the following sections.

- INTRODUCTION TO MANUAL

You want to start that manual with a brief description of what the manual is and who it is for. That’s important because you want to have it ready for any prospective employee to pick up and take with them. - INTRODUCTION TO THE BUSINESS

Next up is a history of your business, a list of services you provide and the contact information for everyone involved in the business. - PREOPENING PROCEDURES

This section should include everything that you need to do before opening the business. If you are already operating your business you might not think this is necessary but it will be if you ever expand or sell the business. - PERSONEL

In addition to the names of all your employees you should also write down their roles and responsibilities. Employment agreements, job applications and recruitment methods should also be written down in this section. - DAILY OPERATING PROCEDURES

You really need to include everything in this section. From opening the office to closing at the end of the day. To get this done you should write Post-It notes throughout the day with all the minutiae of your daily routine. You should get your employees involved in this as well. - SALE PROCEDURES

The reason to include this section is to ensure consistency of your sales and service across your business. - MARKETING

You might well have a marketing strategy laid out for your business and it’s a good idea to have that written down. Local marketing, public relations and obtaining marketing approval should all be included here. - ADDITIONAL RESOURCES

This can include links for legal or accounting help as well employment law and tax information. - MANAGEMENT DOCUMENTS

In here you can put things like staff policies, sexual harassment policies, job application, drug testing consent forms.

You will find that there will be plenty of information that you will discover about your business while going through this process. It will also be a good refresher for your employees about what is expected of them.

To find the templates please visit our page on Operations Manual.

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

We look at what is required to set your business up for success. Jeremy Streten interviews Warwick Peters from Ray White Commercial North Coast to go through the value of systems and what people look for in their business. Watch to find out more

In Show 016 – Setting your Business up for Success originally broadcast on Facebook Live on Wednesday 20 September 2017 we explore this interesting topic.

Show Notes

Recently on Business Lifecycle TV, we discussed Intellectual Property and how it’s possibly the most valuable part of any business. Having a separate holding company in place to house your IP is a hugely important – especially if you ever plan to sell the company. Having the right corporate structure in place will really help to maximize the value of your firm. Today we are going to learn more about what it takes to sell your business. Joining us for our discussion is Warwick Peters an accredited business broker with Ray White. Warwick previously worked in the financial services industry and in real estate. That experience has helped him to understand how a business can profit and grow.

The sales process as a broker starts with trying to figure out what the client wants to sell. That’s not always a simple process. You first have to determine if the business is something that’s marketable. Then Warwick has to determine if the business is profitable and competitive. The accounts of the business are hugely important in order to determine its saleability. Business owners can often have a very unrealistic view of their company. It’s Warwick’s job to clarify that view.

A good example of this are businesses that are very cash heavy. A car wash, for example, takes in large amounts of cash. That amount is almost never accurately accounted for in the books. The reason is obvious. There is a lot of temptation for owners to pocket some of that cash. But there is an invisible cost to that practice. You might be saving 30 cents on the dollar in tax payments but it will cost you much more. For every $10 thousand the owner is taking out in cash it will end up costing them $40 thousand. Why? Because that revenue isn’t reflected in the books it will diminish the selling price of the business when it goes up for sale.

Another tool that business owners can use when valuing their business is something called EBITA. What’s EBITA? EBITA stands for earnings before tax, interest expense and amortization expense. It provides a clear picture of a company’s finances and to gauge a company’s operating profitability and provides a good indication of cash flow.

A perfect business that is going to be put on the market needs a number of things. Those include the accounts and the history of the accounts. A document outlining the job descriptions of everyone involved in the business. There also needs to be an operations manual detailing how the business is run. Location security is also very important. Where is the business located? Is there a lease or is the property owned?

The operations manual is extremely important for a business sale. The perfect example of what the perfect manual should look like comes from restaurant franchises. The franchisee is provided with a manual that details every aspect of the business. From how the food is prepared to how the books should be kept. The other extreme is the local fish and chips shop. The owner takes money out of the till, nothing is written down, no details on food preparation or suppliers. Those systems have to be put in place before the business can be put on the market. You never know when you are going to have to sell the business.

Warwick likes to describe his advice with three words: plan, plan, plan. Always plan on what your future is going to be and what you are going to need to make that a reality.

CONTACT

Warwick Peters

[email protected]

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

In this episode of Fast Fix Monday we go through the Structures that we are dealing with in Asset Protection.

In Show 015 – Structures Behind Asset Protection originally broadcast on Facebook Live on Monday 18 September 2017 we explore this interesting topic.

Show Notes

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

Do you know the difference between copyright and trademarks? In this episode we go through the difference and when to use them in depth.

In Show 011 – Copyright and Trademarks originally broadcast on Facebook Live on Thursday 6 September 2017 we explore this interesting topic.

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

Show Notes

What is the PPSR?

The Personal Properties Securities Register was introduced in 2012. It offers an online database for certain kinds of assets. If you’re lending to someone purchasing an asset it also allows you to take security over those assets. It’s basically an online notice board. Prior to this there were something like 40 registers scattered around Australia. Remember, this is security over personal property as opposed to real property. There is already a land titles registration system in Australia. Personal property is something else. It’s basically anything that isn’t land, buildings or fixtures. That can include vehicles, boats, aircraft, crops, cattle or other livestock. You can also list intangible products like patents or trademarks. You can also take security over shares, cash and cheques.

When should I use the PPSR?

You need to know the practical use of the PPSR for you or your clients. The most obvious use is whenever you are negotiating the sale of personal property. You need to ensure that there are no encumbrances over that property. Imagine if you are a business owner and you are buying another business. You will want to make sure that what you are buying isn’t encumbered somewhere else.

As I mentioned before the previous registers were lumped together in the PPSR. That means that the same items could have been listed on multiple registries. This can be really problematic when purchasing assets. You are going to want to do multiple searches on the business licenses, the ABN or ACN’s or individual serial numbers. Anything and everything you have information on should be searched to make sure that there isn’t security on those items elsewhere. Another example is when you’re buying a car. You want to make sure that car is actually owned by the seller.

Another common mistake we see is during the purchase of goods for a business. People can purchase those goods in their name, not the businesses name. This creates a problem when someone tries to sell their business. The assets will listed under a personal name, not the business name and are therefore encumbered. If you are offering credit to someone you want to make sure you are registering your securities on those loans. If you are leasing your goods or equipment to clients you should be registering those items as well.

Migration issues

Anyone who was using the old registry regime knows that there were different charges on property levied by ASIC. There was a fixed charge or a fixed and floating charge. Fixed and floating charges governed all the property owned by a company. Fixed charges were only for a specific item. When they brought all the registries together a lot of the fixed charges became fixed and floating charges. That created a major problem. In PPSR language these are called ‘All present and after – acquired property – no exceptions’. If there was multiple lenders on those items it will create a lot of headaches. Most banks were pretty understanding about this issue but it still remains a problem. If you have clients that have property registered before 2012 it is worthwhile to check to make sure they have been registered correctly. The other migration issue relates means you really need to check to make sure that their registrations are current and up to date.

Priorities

Depending on what’s registered on the PPSR and when it’s registered determines who has security over that item. If you’re lending money to someone who is buying an asset and you want to get super-priority you should resister your interest on that asset before you lend the money. In a practical sense you might sign a loan for an asset. The bank will then register their interest and then will approve the loan.

Retention of title clauses

These have been around for many years. If you sell some goods to a person but aren’t going to be paid for 30 days you will retain title in those goods. Provided you have an agreement that includes retention of title you are going to want to register your interest in that item. If you do it correctly you will be given super-priority over those goods. You should complete the registry after you sign the agreement but before you hand over the goods. One of the benefits of doing this way is that there is a clear set of rules about how you can get those goods back. You do have to take into account the commerciality of the good. If it’s just single widget you aren’t going to bother.

Enforcing your interest

If a customer hasn’t paid if you’ve properly registered those items you will be allowed you to seize the goods. In addition, when you have your register and super-priority in place you will be able to bring those into force during the liquidation process. That property will not be liquidated.

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.

Do you want to learn more about what asset protection strategies you need for your business?

In Show 13 – Asset Protection Strategies for Intellectual Property originally broadcast on Facebook Live on Wednesday 13 September 2017 we explore this interesting topic.

Show Notes

Today we want to talk about how to protect the most important part of your business. Intellectual property is completely invisible but it is probably your most valuable asset. In the past IP protection was among the first things businesses would undertake before they start-up. In the Business Legal Lifecycle we understand that’s no longer practical. Instead we have placed it as Phase 5 of any start-up plan. Why do we structure the Business Legal Lifecycle that way? We do this because it’s part of the cost-benefit analysis of a start-up business. It used to take $20,000.00 $50,000.00 to start a business. Nowadays all it takes is a laptop. The traditional legal advice is that you should start up the asset protection and trademark at the beginning. Very few businesses have that kind of capital.

By the time you reach Phase 5 your business will have already completed your start-up. Intellectual property protection should come after that because it helps you to scale the business. By the time you have a business asset that’s worth protecting you could lose everything if you don’t have your IP defended.

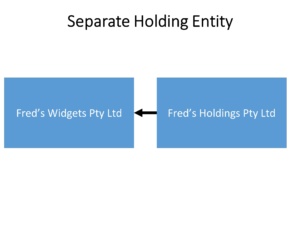

The best way to do that is to create a separate legal entity to house all your IP. A separate legal entity will protect your IP if you are ever sued or go bankrupt or are involved in a lawsuit. IP is the intangible part of your business. You can’t see or touch it like a piece of equipment. But it is potentially far more valuable. In fact it might be the most important asset you have. You always need to be ready to sell the business and IP protection is a big part of that. Trademarks, patents, and other ideas all make up your invisible assets that represent the real value of what you’ve built in your business.

We have helped a number of clients to protect their IP. One good example was a company that provides professional services for employers. They had built up a large portfolio of intellectual assets. We structured their business so that the IP was protected in a separate legal entity that would be protected in case of a lawsuit or bankruptcy. By doing that it allowed the firm to license that IP to other companies.

Avoiding the taxman is another good reason to protect your IP early. Normally your IP isn’t worth a lot at the start of the business. When you do make the transfer to a separate entity the IP will be taxed just like any other capital gain. That’s why you should make that transfer as early as possible so you don’t have to pay as much tax.

There isn’t really any other way to protect your IP going forward. You have to ask yourself what you are you really protecting. Then you need to figure out who really owns that IP. Then you need to sit down with your accountant to really understand what it is you’re creating.

More about this Show

We started Business Legal Lifecycle to create a simple way for you to understand complex legal terms. Most importantly we want to help you to develop a plan to take your business successfully into the future. There’s a startling statistic the underscores the importance of developing a solid plan. The majority of business owners are just seven months away from losing everything. A single aspect of your business that is not set-up correctly can shut down your whole operation very quickly. Legal advice is not cheap and even when you can afford it there is often a divide between lawyers and their clients. We want to close that gap once and for all. We want to put legal knowledge and tools into your hand to prevent the worst from happening to you.

Twice a week we are going to deliver those tools right to your home or office with Business Legal Lifecycle TV. We’ll start the week with Fast Fix Monday, a short 5-10 minute video that will tackle a single issue that businesses have to deal with. Then on Wednesday’s our main show will feature with more fulsome discussions and interviews all delivered in a straightforward and easy to understand format.